- Open an account

- Log in

- My Easy Banking

-

-

Personal information

-

My documents

-

Privacy

-

Settings

-

Logout

-

Daily banking

Bank accounts

Bank cards

Payments

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Financing a property

Finance a vehicle

Family protection

Home protection

Mobility protection

By your side

Specific approach

Online and mobile banking

You are on the version of the site for

Daily banking

Bank accounts

Bank cards

Payments

Our advice

Did you know?

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Our advice

Did you know?

Financing a property

Finance a vehicle

Fund a project

Our advice

An EPC certificate?

Family protection

Home protection

Mobility protection

Our expertise

An EPC certificate?

By your side

Specific approach

Online and mobile banking

Contact us

Did you know?

-

E-invoicing B2B

4 min

From 1 January 2026, "e-invoicing B2B" or electronic invoicing between businesses will become mandatory in Belgium. With this new law, the authorities are opting for a more harmonised approach. The objective is threefold:

- Increase the competitiveness of businesses by reducing administrative burdens

- Combat tax fraud by automating VAT declarations

- Adapt economic policy based on more qualitative data

The new law applies to both small and large businesses and is a logical evolution in a world that is increasingly digitalising.

How does it work?

In Belgium, one billion invoices are exchanged every year. Currently, this is mostly done by email, with an invoice in PDF format. From 2026, you will have to create and send your invoices via a specific network in a new electronic format. All invoicing data will be included in a structured manner and this format can be fully read by software. This will enable the optimisation and automation of processes.

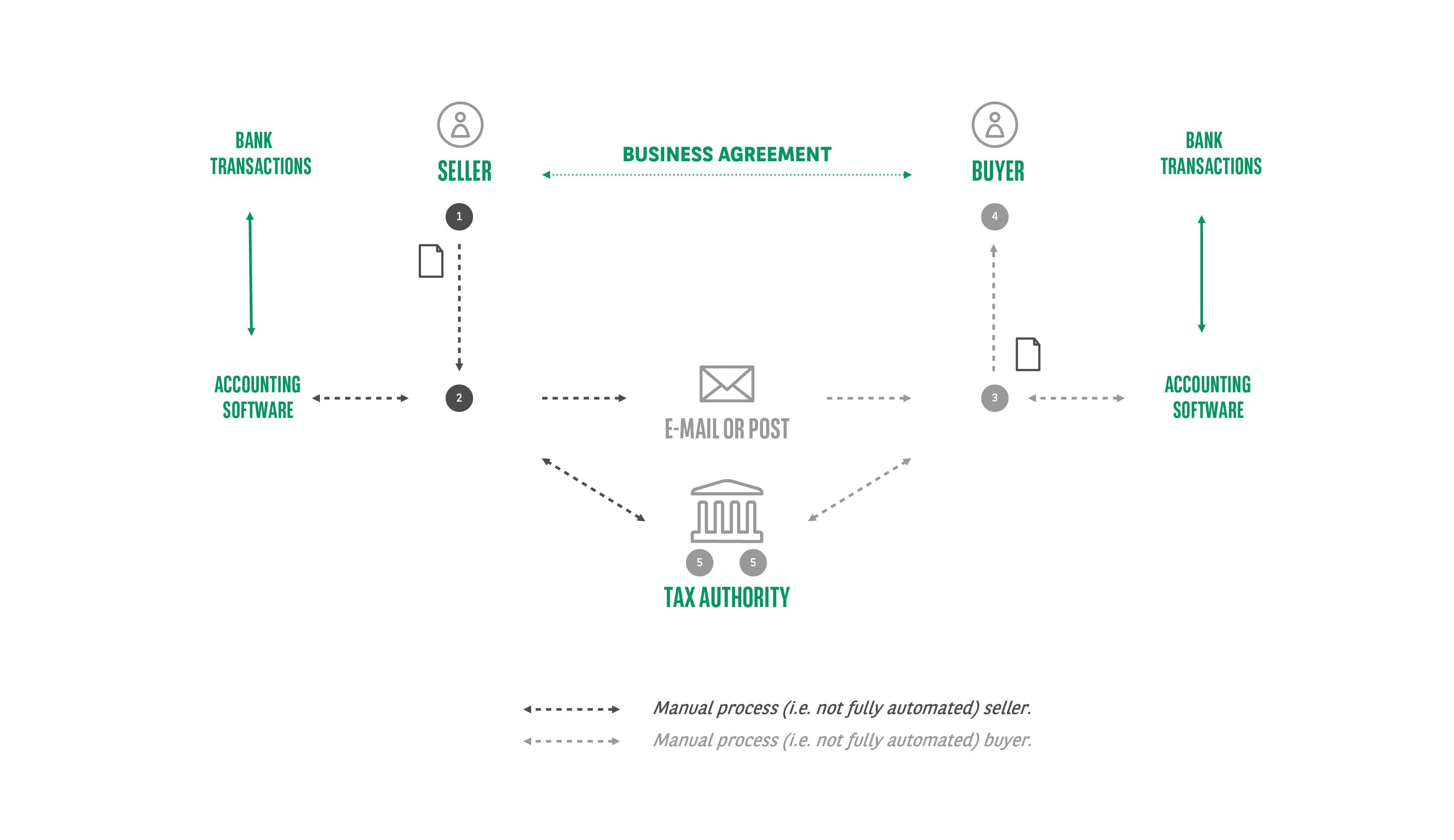

Traditional invoicing process

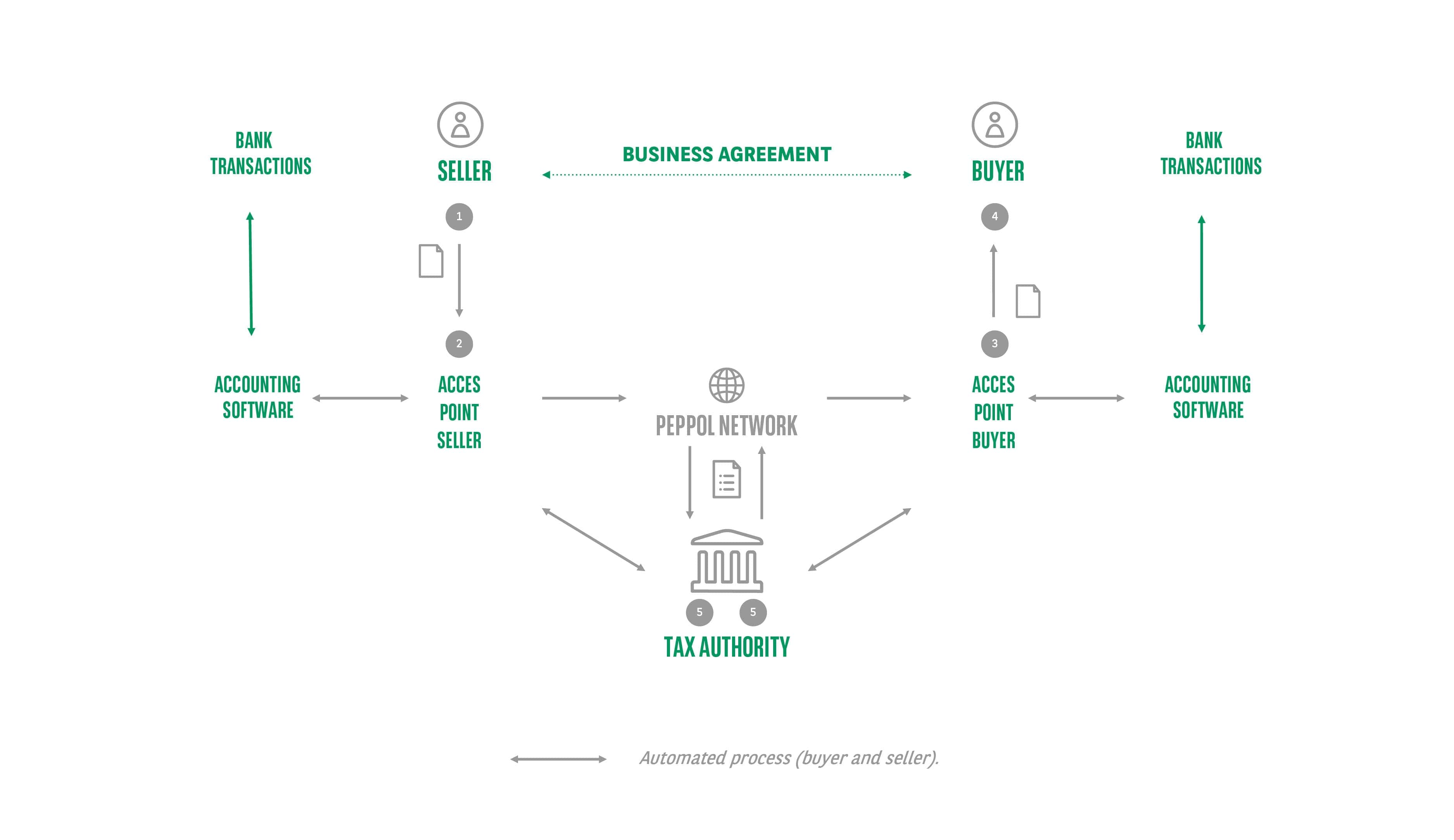

E-Invoicing process

Who is part of the ecosystem?

There are four important players in this new ecosystem:

- Traditional banks

Some banks already have solutions for e-invoicing.

- Fintechs

In addition to payment solutions, they also offer e-invoicing services and compete with traditional banks.

- Accounting platforms

They offer extended financial management services, including electronic invoicing modules.

- Invoicing service providers

They have tools to create, send, receive and manage invoices and also offer services such as "embedded finance".

What solutions do electronic invoicing platforms offer?

- Create an electronic invoice with one click

- Send and receive electronic invoices via a regulated protocol

- Archive electronic invoices and link them to accounting software

- Use an analysis tool to map cash flows

What is the role of our bank?

As your trusted financial partner, we are by your side, offering you the solutions you need and giving you access to our partner ecosystem. We do not intend to replace accounting programmes or fintechs. We are always ready to help with payment and financing questions.

- In the short term, we inform you about this new law on mandatory e-invoicing between businesses and answer your questions.

- In the medium term, we want to finance your receivables even faster and more efficiently, so you can more easily access your working capital.

- In the long term, we are working on a solution that will integrate electronic invoice data into our app, so you can perform a risk analysis based on this data.

Benefits

The new law is the result of various developments and initiatives at European level and offers three major benefits:

- Increased competitiveness of businesses thanks to reduced administrative burdens

- Reduced tax fraud thanks to the automation of VAT declarations

- Adaptation of economic policy based on more qualitative data

Good to know

Even if the introduction of mandatory e-invoicing between businesses seems far away, it is better to start preparing as soon as possible. Because this obligation will be imposed all at once. As a business, set up a plan to be ready to comply with the law from 1 January 2026.

The proposed changes will not only impact many teams within your organisation (accounting, IT, etc.), but also the processes and technology in place. If you do not manage these issues correctly, this may result in significant additional costs.

Useful links

Help

Daily banking

Save and invest

© 2025 BNP Paribas Fortis