Warning

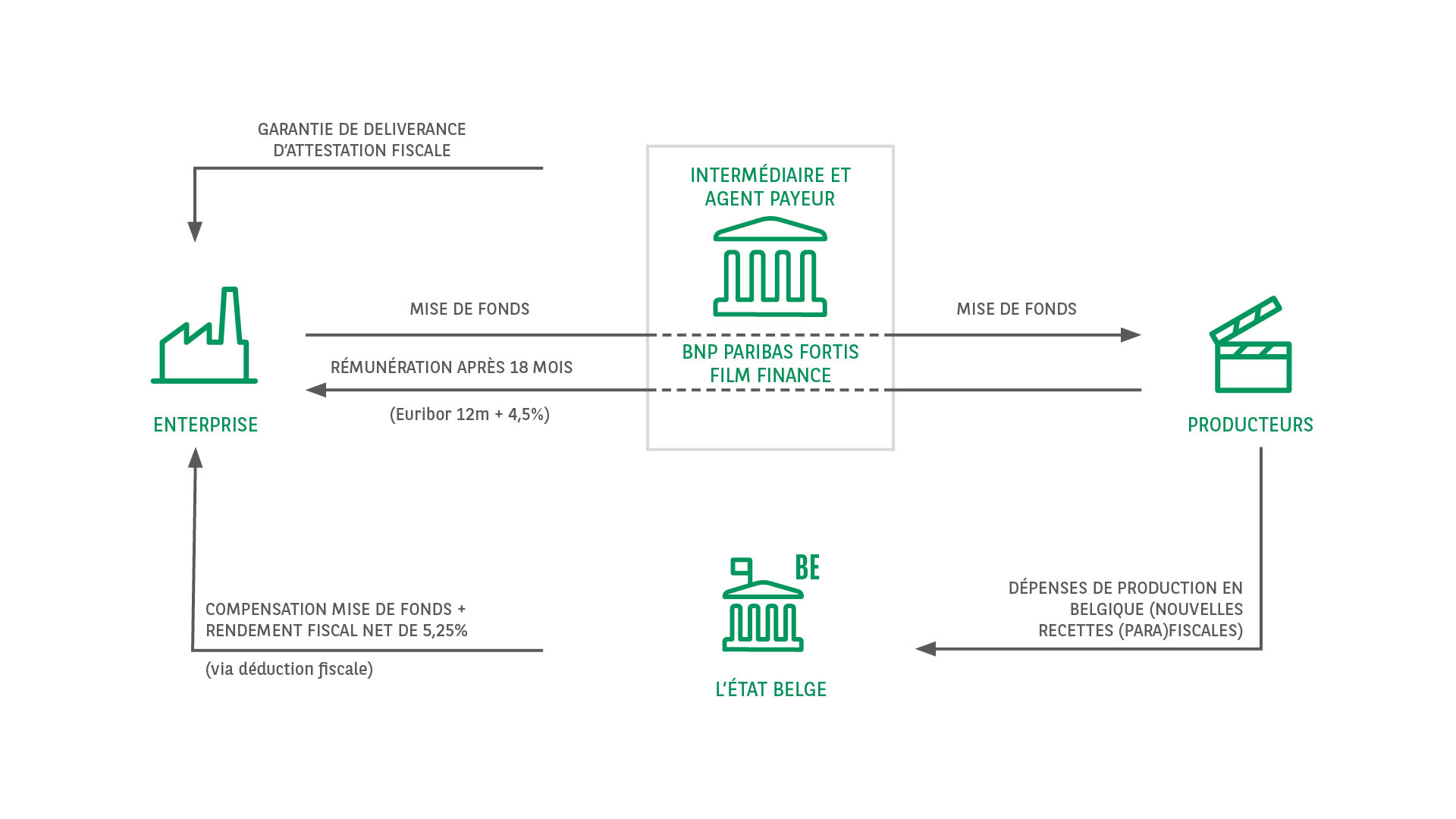

A tax shelter subscription through BNP Paribas Fortis Film Finance, a subsidiary of BNP Paribas Fortis, is governed by the Belgian regime on audiovisual and stage productions as defined under Articles 194ter and 194ter/1 of the Income Tax Code.

Investments in the financial operation proposed are intended for businesses taxed at the standard corporate tax rate, i.e. 25% .

Investing in a tax shelter involves certain risks, including the fact that the tax benefit is obtained immediately but is not permanent. You only get a permanent tax benefit should a number of conditions be met. Before investing, please read the Prospectus and, in particular, please make sure that you are aware of all the risks relating to this financial operation (see below). In order to take advantage of this product, a company needs to generate a sufficient increase in taxable profits compared to the intended subscription amount, and must account for it in the manner required by law. We therefore strongly advise you to consult your accountant or a financial or tax adviser.