The benefits of a pension savings fund

Discover the diversification, flexibility, and tax benefits offered by a pension savings fund.

You are on the version of the site for

You choose a mutual investment fund under Belgian law, managed by BNP Paribas Asset Management Europe, Belgian Branch, which invests in equities and bonds. There is no capital guarantee or return guarantee, but in the long term, you accept certain risks in exchange for an attractive potential return.

Investing in a pension savings fund allows you to benefit from a tax reduction of 25 or 30%. Take advantage of this tax benefit while investing for your pension. You can find more information about these tax benefits, fees, and taxes related to this type of fund on this page.

Start a pension savings plan today via Easy Banking Web. You can open and manage it online yourself, without the help of an advisor.

Here are the conditions for opening a pension savings plan:

Please note that you cannot open a pension savings plan in the situations listed in the document detailing the tax conditions for opening a pension savings plan.

BNP Paribas B Pension Sustainable Stability, BNP Paribas B Pension Sustainable Balanced, and BNP Paribas B Pension Sustainable Growth are open-ended investment funds (FCP) without a predetermined maturity date, pursuing the same objectives:

To achieve these objectives, they invest in various asset classes (shares, bonds, collective investment schemes (CIS), money market instruments, and cash), without geographical or sectoral limits.

Although they are all characterised by a globally prudent management approach, these three pension savings funds differ in the weight they allocate to shares in their portfolios:

These three pension savings funds are actively managed and can therefore invest in securities that are not included in their respective reference indices.

The reference index is composed of a combination of underlying indices, varying in proportion according to the risk profile: MSCI Europe Small Caps (USD) NR, MSCI World ex-EMU (USD) NR, MSCI EMU (EUR) NR, Bloomberg Euro Aggregate Corporate 500MM EEA Countries (EUR) RI, and Bloomberg Euro Aggregate Treasury 500MM (EUR) RI.

These reference indices are used for performance comparison purposes but do not reflect the environmental and social characteristics of the funds.

The benefits of a pension savings fund

Discover the diversification, flexibility, and tax benefits offered by a pension savings fund.

Your pension savings fund is diversified

The portfolio composition includes various asset classes that are highly diversified (bonds, shares) and meets strict rules that ensure thoughtful asset management.

Your pension savings fund is flexible

If ever your financial situation changes, you can opt for another pension savings fund from our range at any time, free of charge and without any limit. You don't change your pension savings account: there is no tax impact.

Your tax deduction, in precise terms

In 2025, you have the choice between two tax ceilings for pension savings: the default ceiling of €1,050 (basic ceiling), with a tax reduction of up to 30%, i.e. €315, and a saving on municipal tax. If you want to open your pension savings plan online, the only option offered is the basic ceiling.

The higher ceiling is not available online. It amounts to €1,350, with a tax reduction of up to 25%, i.e., €337.50, and a saving on municipal tax. To benefit from it, please make an appointment with an advisor.*

You can easily manage your pension savings yourself

Pension savings are already available from €25 per month or €300 per year. We recommend that you pay a fixed amount into your pension savings plan via bank transfer. If you open a pension savings plan online, the monthly transfer is the only option offered. However, once opened, you can adjust the amount, payment method, and tax ceiling in Easy Banking Web at any time.

* More information about your tax benefit and the maximum amount of pension savings in 2025.

When you start saving for your pension before the age of 55, the final tax is levied in the year you turn 60. You can continue to contribute to your pension until the year you turn 64. These payments are twice as interesting: they are exempt from final tax, and you can benefit from the tax benefit!

These pension savings funds promote environmental and social characteristics. In this context, the manager pays particular attention to environmental, social, and governance (ESG) issues through two approaches:

The three pension savings funds can also invest up to 10% of their assets in collective investment schemes (CIS). However, these CIS must have received the Towards Sustainability label or have committed to obtaining it within six months. If they fail to obtain it in time or if a CIS in the portfolio loses its sustainability label, the unlabelled CIS must be sold within 10 days.

You can find more information about the global sustainable development policy of BNP Paribas Asset Management in the prospectus of each pension savings fund.

Warning: the decision to invest in one of these pension savings funds must take into account all their characteristics and objectives, as described in the prospectus and key information documents.

The pension savings funds marketed by BNP Paribas Fortis carry the Towards Sustainability label. Regularly re-evaluated and under permanent watch, this sustainability label is a quality standard supervised by the Central Labelling Agency (CLA). To meet this standard, financial products must meet a number of minimum sustainability requirements, both at the portfolio and investment process levels. You can find more information about the label on the CLA website.

Obtaining this label does not mean that the pension savings fund meets your own sustainability objectives.

These pension savings funds do not provide protection against market fluctuations. You may therefore lose all or part of your investment.

The risks specific to each pension savings fund may vary depending on the allocation between shares and bonds in the portfolio.

Credit risk: this risk concerns the ability of an issuer to meet its commitments. A downgrade of an issuer's rating can lead to a decline in the value of the assets in the portfolio, impacting the fund's overall performance.

Liquidity risk: in a tight market, a lack of buyers can make it difficult to sell an asset at its fair value and at the desired time.

Currency risk: this risk arises from the presence in the portfolio of assets denominated in currencies other than the euro.

Inflation risk: a sustained increase in inflation can erode the value of the invested money.

The prospectus and key information document of each pension savings fund describe the risks associated with investing in these funds.

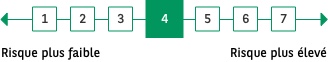

Calculated by BNP Paribas Asset Management, the risk indicator assesses the risk level of the pension savings fund compared to other investment products. It indicates the probability of losses in the event of market movements or the manager's inability to reimburse the investor. This indicator is neither an objective nor a guarantee. The lowest level (1) does not imply that an investment is risk-free. Other relevant risks for the fund, not taken into account by the indicator, are exposed above.

Recommended investment horizon: the potential investor should have an investment horizon of at least 10 years. The risk indicator assumes that the fund is held for the entire period.

Capitalisation shares only (ISIN code BE0946410785)

Capitalisation shares only (ISIN code BE0026480963)

Capitalisation shares only (ISIN code BE0946411791)

You pay 3% entry fees each time you invest in the pension savings fund of your choice.

Overview of the costs of the 3 pension savings funds

|

BNP Paribas B Pension |

Sustainable Stability |

Sustainable Balanced |

Sustainable Growth |

|

Entry fees |

3% |

3% |

3% |

|

Exit fees |

0 |

0 |

0 |

|

Ongoing fees (at 31 December 2023) |

1,45% |

1,42% |

1,40% |

Ongoing fees may vary from year to year and are directly deducted from the fund's net asset value. They cover management costs and other administrative and operational costs, as well as transaction costs.

You start a pension savings plan before your 55th birthday? You will pay a final tax of 8% in the year you turn 60.

You start it after 55? In this case, you will pay a final tax on the 10th anniversary of your pension savings contract.

The final tax will be calculated on your net contributions, capitalised on a fictitious annual return of 4.75% (6.25% for contributions before 1992).

What happens if you want to receive your capital earlier?

Do you have questions about pension savings taxation? Please do not hesitate to contact your agency or your usual advisor.

BNP Paribas B Pension Sustainable Stability, BNP Paribas B Pension Sustainable Balanced, and BNP Paribas B Pension Sustainable Growth are Belgian open-ended investment funds (FCP).

Management company: BNP Paribas Asset Management Europe, Belgian Branch, a French-law company.

Financial service: BNP Paribas Fortis

The subscription of participation rights is made through a payment into a pension savings account. Entry fees are deducted from the received payment, after which (fractions of) shares are subscribed at the next net asset value. There is no minimum subscription amount or end date.

Subscriptions are possible every banking business day (before 4 pm) based on the net asset value (NAV). The net asset value is published every banking business day on the website www.beama.be.

Complaints

You can send any complaint about our products or services by mail to BNP Paribas SA – Complaint Management Service – Montagne du Parc 3, 1000 Brussels or by email to complaint.management@bnpparibasfortis.com.

If the proposed solution does not satisfy you, you can send your complaint by mail to Ombudsfin – Service de médiation des services financiers – North Gate II, Boulevard du Roi Albert II 8/2, 1000 Brussels or by email to ombudsman@ombudsfin.be.

This document is a commercial communication. A summary of investors' rights is available, in French and Dutch, on the BNP Paribas Asset Management website.

The prospectuses and key information documents of the three pension savings funds are also available, in French and Dutch, on the BNP Paribas Asset Management website (please enter the ISIN code or the name of the pension savings fund you are looking for).

Warning: this communication is a commercial communication. The investor is required to read the key information document and the prospectus of the pension savings fund carefully before making any investment decision.

To start a pension savings plan online, simply log in to your Easy Banking Web.

Select a pension savings fund, specify the start date and the monthly amount you want to pay.

Just sign online

If you wish to open a pension savings plan online, you do so without investment advice and under your own responsibility. It is up to you to choose the pension savings fund in which you invest. Furthermore, you cannot select your tax ceiling online. The default base ceiling of €1,050 applies, along with monthly payments via direct debit.

54 is an important age for your pension! Discover why and what needs to happen before you turn 55!

What is final taxation and what does it mean for your pension savings and long-term savings? Discover more in our article.

Want to make the most of your tax-efficient savings? Discover how to combine them effectively with a mortgage!

© 2024 BNP Paribas Fortis

Session number: