- Open an account

- Log in

- My Easy Banking

-

-

Personal information

-

My documents

-

Privacy

-

Settings

-

Logout

-

Daily banking

Bank accounts

Bank cards

Payments

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Financing a property

Finance a vehicle

Borrowing money also costs money

- Discover the personal instalment loan to also finance higher education

Family protection

Home protection

Mobility protection

By your side

Specific approach

Online and mobile banking

You are on the version of the site for

Daily banking

Bank accounts

Bank cards

Payments

Our advice

Did you know?

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Our advice

Did you know?

Financing a property

Finance a vehicle

Fund a project

Our advice

Borrowing money also costs money

Borrowing money also costs money

- Discover the personal instalment loan to also finance higher education

Family protection

Home protection

Mobility protection

Our expertise

Did you know?

By your side

Specific approach

Online and mobile banking

Contact us

Did you know?

SAVINGS AND INVESTMENTS

BNP Paribas B Strategy Global Sustainable Aggressive fund

Managed by BNP Paribas Asset Management Europe, Belgian Branch

International diversification

To spread the risks of your investment, our specialists select investment funds that focus on international diversification.

The Global Sustainable Aggressive sub-fund of the Belgian BNP Paribas B Strategy Sicav has no set duration and does not offer capital protection.

Ready-to-use formula

Managing a portfolio of investments requires a lot of knowledge and information, close monitoring, and good decision-making skills.

By opting for a sub-fund of the BNP Paribas B Strategy Sicav, you don’t have to your portfolio yourself. Our specialists closely monitor the fund and take action when necessary.

Also for small amounts

Flexinvest allows you to make automatic regular investments from €30 per month.

However, you can also pay in the amount of your choice and request a withdrawal whenever you want, at the applicable net asset value.

How does this investment fund work?

The BNP Paribas B Strategy Global Sustainable Aggressive sub-fund aims to achieve the best possible return while ensuring a broad distribution of risks. To do this, it invests globally via other investment funds that invest in different asset classes (equities, bonds and alternative investments).

The fund is actively managed. It can therefore invest in securities that are not included in its benchmark index. The latter is made up of the following sub-indices, in proportions that reflect the sub-fund’s risk profile: STOXX Europe 600 (EUR) NR, EURO STOXX (EUR) NR, S&P 500 Composite (EUR) NR, Topix 100 (EUR) RI, MSCI Emerging Markets (EUR) NR and Cash Index €STR (EUR) RI. The benchmark index is used for performance comparison purposes, and is not suitable as a benchmark for environmental and social characteristics.

The sub-fund’s neutral weightings are as follows: 95% equities, 0% bonds, 5% alternative investments and 0% cash and money market instruments. However, managers can, depending on market conditions and their forecasts, deviate from those weightings within the following ranges: equities 45%-100%, bonds 0%-25%, alternative investments 0%-40%, cash and money market instruments 0%-50%.

Investing through a collective investment undertaking (CIU)

The golden rule of investing is diversification. The more assets your portfolio contains, the more the risk is diversified. Managing a portfolio requires close monitoring, sufficient knowledge and information and good decision-making skills, but also strong nerves when markets are turbulent.

Investing through a collective investment undertaking (CIU) allows you to overcome these constraints with ease. You aim to achieve the potential return of a widely diversified portfolio and delegate its management to professionals whose goal is to grow your capital over the long term.

General sustainability policy

This sub-fund seeks to have environmental and/or social characteristics, paying particular attention to environmental, social and governance issues.

Among a wide universe of CIUs, managers select the funds that will enable them to implement strategic decisions in terms of portfolio composition. But not just any funds: at least 90% of the funds included in the portfolio must have obtained the Towards Sustainability label or be committed to obtaining it within 6 months of entering the portfolio.

The other funds (up to 10%) are funds that either seek to have environmental or social characteristics and good governance practices or pursue a sustainable investment objective.

At least 90% labelled funds

When the Towards Sustainability label is awarded to a fund, it means that its managers act in a socially responsible way by paying particular attention to social, environmental and governance issues in their investment decisions.

- Managers do this by applying the following three strategies:

- environmental responsibility: pollution control, waste management, energy efficiency etc.

- social responsibility: respect for diversity, staff training, accident prevention etc.

- good corporate governance: transparency of accounts, anti-corruption efforts, independence of the board of directors etc.

- The use of norms-based screening founded on international standards, such as the principles of the United Nations Global Compact.

- The application of exclusion lists to eliminate companies involved in highly harmful or controversial activities such as tobacco, coal, arms, unconventional gas and oil extraction etc.

Managers must apply at least one additional sustainability strategy in addition to these three strategies. For example, they must seek a higher average ESG score than the reference universe, take a "Best in class" approach consisting of favouring companies with the best ESG scores within their sector, apply a sustainable investment theme such as water, climate change or human capital, or make solidarity-based investments that provide financial support to a charity or environmental project.

The decision to invest in a Global Sustainable sub-fund must take into account all of the sub-fund’s characteristics and objectives, as described in the prospectus and the key information document.

The Towards Sustainability label

This sub-fund has held the Towards Sustainability label since November 2019. The label is regularly reassessed and constantly monitored, and is a quality standard supervised by the Central Labelling Agency (CLA). This standard defines a number of minimum requirements that sustainable financial products must meet as regards both their portfolios and investment processes. You can find more information about the label on the CLA website.

If a fund obtains this label, this does not necessarily mean that it will meet your own sustainability objectives.

What risks does this investment present?

This sub-fund does not provide protection against market fluctuations, so you may lose some or all of your investment.

Credit risk: if the financial situation of an issuer deteriorates, the value of the bonds included in the portfolio may decrease.

Liquidity risk: if the market for an asset is too narrow, a lack of buyers may make it difficult to sell the asset at a fair price and at the desired time.

The prospectus and key information documents together describe all the risks involved.

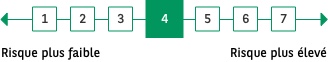

Risk profile

A fund's risk profile is determined by the types of assets it invests in (equities, bonds, cash etc.). Risk is measured on a scale of 1 to 7, with level 1 corresponding to the lowest risk and level 7 to the highest risk. The risk indicator indicates the probability that you will incur losses in the event of market movements or if the management company is unable to reimburse you.

The risk indicator is calculated by BNP Paribas Asset Management and assumes that you comply with the recommended investment timeframe of at least 5 years.

Other relevant risks for the fund, but not taken into account by the risk indicator, are mentioned above.

How are risks spread?

Even with a modest initial investment, you can be sure that the risks are spread in a suitable way thanks to extensive diversification:

- across different categories of investments (equities, bonds, alternative investments and cash) across various investment funds;

- geographically, as not all regions of the world share the same growth rates, risks or growth potential.

Dividend or no dividend?

If this investment fund generates profits and you have bought income units, a dividend may be paid to you. If you opt for accumulation units, you will not receive a dividend and your share of the profits will be reinvested in the fund. When you sell your units, you will recover the value of those profits (see also the "Taxation" section).

The BNP Paribas B Strategy Global Sustainable Aggressive sub-fund offers both types of units:

- "Classic Distribution" income units: ISIN code BE0935065822

- "Classic Capitalisation" accumulation units: ISIN code BE0935066838

Taxation

Withholding tax

- You pay 30% withholding tax on dividends paid out by your income units.

- If more than 10% of the sub-fund’s portfolio is invested in debt instruments (bonds), you will pay 30% withholding tax on the returns generated by those instruments. In other words, only a small part of the potential capital gain realised when selling your units will be subject to withholding tax.

Financial transaction tax (FTT)

- No FTT when you buy units.

- When you sell units, FTT is payable at 1.32% for accumulation units only, up to a maximum of €4,000 per transaction. The tax is levied on the value of your units at the time of sale.

This tax regime applies to private investors in Belgium and may change in the future. Other categories of investors are invited to enquire about the tax regime applicable to them.

Fees

- When you buy units: 2.50% of the amount invested.

- When you sell units: no fees.

- Ongoing fees (calculated as of 31 December 2023): 2.11% on an annual basis. Ongoing fees may vary from year to year. They are levied each year and based on the sub-fund’s value. They cover management fees and other administrative and operating fees as well as transaction costs.

- Conversion commission: maximum 1.25%.

- Custody fees: free custody in a securities account held with BNP Paribas Fortis.

Good to know: the BNP Paribas B Strategy Sicav may apply the "swing pricing" method to determine the net asset value (NAV) of its sub-funds. This method factors in taxes and day-to-day transaction fees – provided they do not exceed 1% of the NAV – resulting from purchases and sales of units by investors, which affect the value of the fund and all its investors.

More Information

The Global Sustainable Aggressive fund is a sub-fund of BNP Paribas B Strategy, a Belgian Sicav that has no set duration and offers no capital protection.

Warning: this is a marketing document. The investor should read the key information document for accumulation units, the key information document for income units and the prospectus carefully before making any investment decision. These documents are available free of charge, in French (using the links above) and in Dutch, in any BNP Paribas Fortis branch.

Useful information for investors:

- Periodic report

- Fees and charges for the main securities transactions

- Standard terms and conditions of investment services

- Financial instruments information brochure

Management company: BNP Paribas Asset Management Europe, Belgian Branch, a French-law company.

Financial servicing: BNP Paribas Fortis.

Units can be purchased every banking business day based on net asset value (NAV). If you buy through a Flexinvest plan, the purchase can be split up into thousandths of a unit. Net asset value (NAV) is published every banking business day on the www.beama.be website.

Complaints

Any complaint about our investment products or services should be sent by post to BNP Paribas Fortis SA – Complaints Department– Montagne du Parc 3, 1000 Brussels or by email to gestiondesplaintes@bnpparibasfortis.com.

If you’re not happy with the proposed solution, you can send your complaint by post to Ombudsfin – Financial Services Mediation Service - North Gate II, Blvd du Roi Albert II 8 (Bte 2), 1000 Brussels or by email to ombudsman@ombudsfin.be.

A summary of investors' rights is available, in French and Dutch, on the BNP Paribas Asset Management website.

Help

Daily banking

Save and invest

© 2024 BNP Paribas Fortis

Session number: