- Open an account

- Log in

- My Easy Banking

-

-

Personal information

-

My documents

-

Privacy

-

Settings

-

Daily banking

Bank accounts

Bank cards

Payments

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Financing a property

Finance a vehicle

Family protection

Home protection

Mobility protection

By your side

Specific approach

Online and mobile banking

You are on the version of the site for

Daily banking

Bank accounts

Bank cards

Payments

Our advice

Did you know?

Save and invest

Invest

Save and invest with a goal

Our investment solutions

Our advice

Did you know?

Financing a property

Finance a vehicle

Fund a project

Our advice

An EPC certificate?

Family protection

Home protection

Mobility protection

Our expertise

An EPC certificate?

By your side

Specific approach

Online and mobile banking

Contact us

Did you know?

BY YOUR SIDE

Informing the bank about the death of a loved one

Losing a loved one is a particularly painful ordeal. We want to be by your side at this difficult time, helping you to deal with banking and other formalities: you can find out more on this page. For your convenience, you can register the death with us online. And of course, you can talk to us by phone or in a branch.

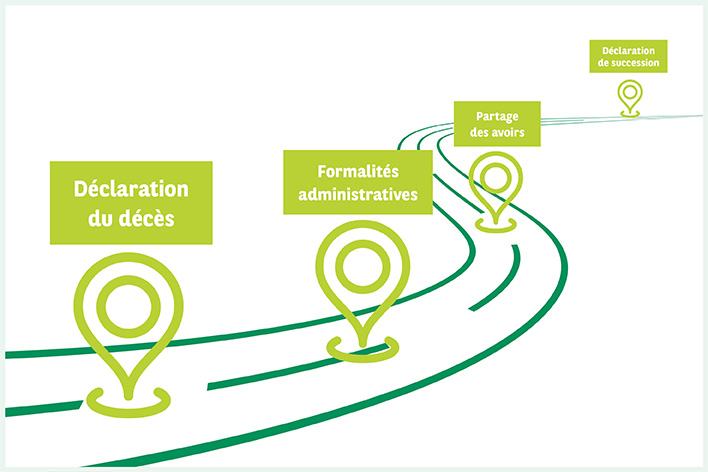

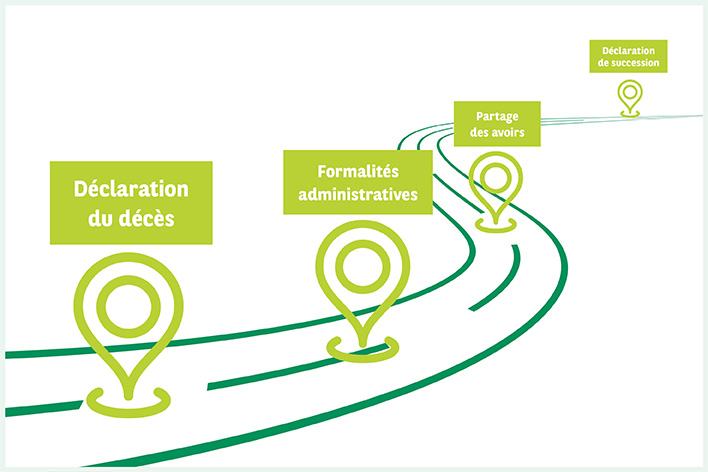

The steps you need to take

Many things need to be dealt with, sometimes very quickly, and you may not know where to start. This step-by-step plan will guide you.

-

Register the death

Immediately register the death with your bank. How do you do that? What do you need? What happens next?

-

Administrative formalities

Even though you may not feel like it, there are a lot of practical matters to deal with. What about ongoing bills? How do you request a certificate of inheritance? Do you need to call a notary?

Register the death

The first step is to register the death as soon as possible with the local authority in which your loved one passed away. Often, the funeral home takes care of it. You will then receive a copy of the death certificate. With this document, you or another person can register the death with us:

- 24/7 online

- At a post office during opening hours

- At your bank branch, by appointment

After the death has been registered, we inform you of the necessary documents to release the deceased person’s assets. You will receive the contact details of advisors who will be happy to answer your financial questions regarding inheritance.

Administrative formalities

As a bank, we are legally required to temporarily block the deceased person's assets: accounts, cards, access to Easy Banking Web and Banking App, safe deposit boxes etc. No transactions can take place without the consent of all heirs.

However, there are solutions to help you manage ongoing day-to-day payments:

- Certain death-related bills can be paid from the blocked payment account, if the balance is sufficient: just send them to the bank.

- If you’re married under the separation of property regime, your account will be unblocked after confirmation by the notary.

- In some cases, the surviving spouse can request a statutory advance.

After the death has been registered, all necessary information is given to the heirs or the contact person.

Release of assets

After receiving all the documents, we contact all the heirs and proceed with the distribution of the assets. We do this on the basis of instructions from the heirs or the notary: which accounts should be closed or kept, who the balance should be transferred to, what happens to any investments (transfer or sale) etc.

Make sure you carry out the inheritance registration process on time. It must be done within the following deadlines:

- 4 months for a death in Belgium

- 5 months elsewhere in Europe

- 6 months outside Europe

Also of interest

You’re not alone

-

Answers to your questions

Do you have any questions? Consult our FAQs or call our advisors on 02 762 90 00, 7am to 10pm on working days or 9am to 5pm on Saturdays.

-

Managing the loss of a loved one

We will gladly provide you with more details on administrative formalities. Do you have to accept an inheritance? Who should make the inheritance declaration?

-

Protecting your family

We give various examples of how you can protect the future of your loved ones in the event of your death.

Help

Daily banking

Save and invest

© 2025 BNP Paribas Fortis

Session number: